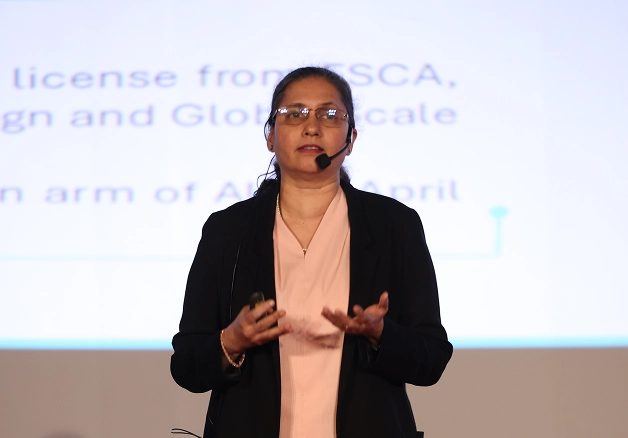

Digital Assets: New Opportunities to Unlock Liquidity, Monetise Assets and Fuel Economic Growth

This panel brought together prominent voices in digital finance to explore how sovereign wealth funds, family offices, and asset owners are investing in blockchain technologies and emerging payment systems to drive liquidity and innovation. Speakers evaluated macroeconomic shifts and regulatory developments—particularly in the Middle East, using the AED Stablecoin as a case study. The session underscored how digital asset platforms and funds are reshaping traditional portfolios, offering a bold new direction for diversification and future-ready investment strategies.

Global Macro: The Impact of Geopolitics and Economic Headwinds

This session featured global leaders addressing how asset owners are navigating an increasingly complex world marked by conflict, climate change, and political volatility. With nearly half the world voting in 2024, the panel examined how long-term strategies can still thrive amidst short-term uncertainty. Speakers shared cross-market insights on risk management, liquidity planning, and portfolio resilience, offering a multidimensional view of how institutions can stay grounded while adapting to rapid global change.

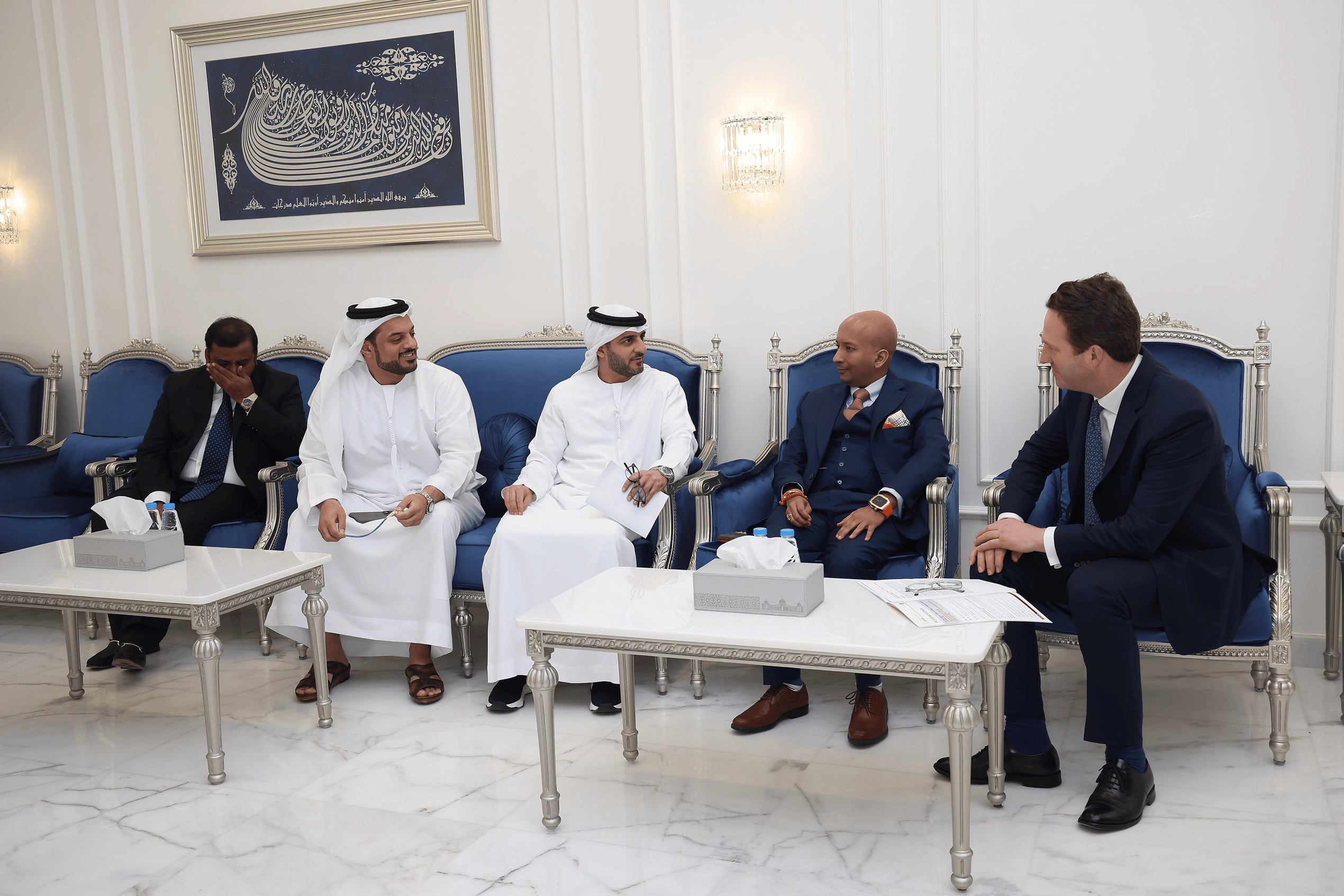

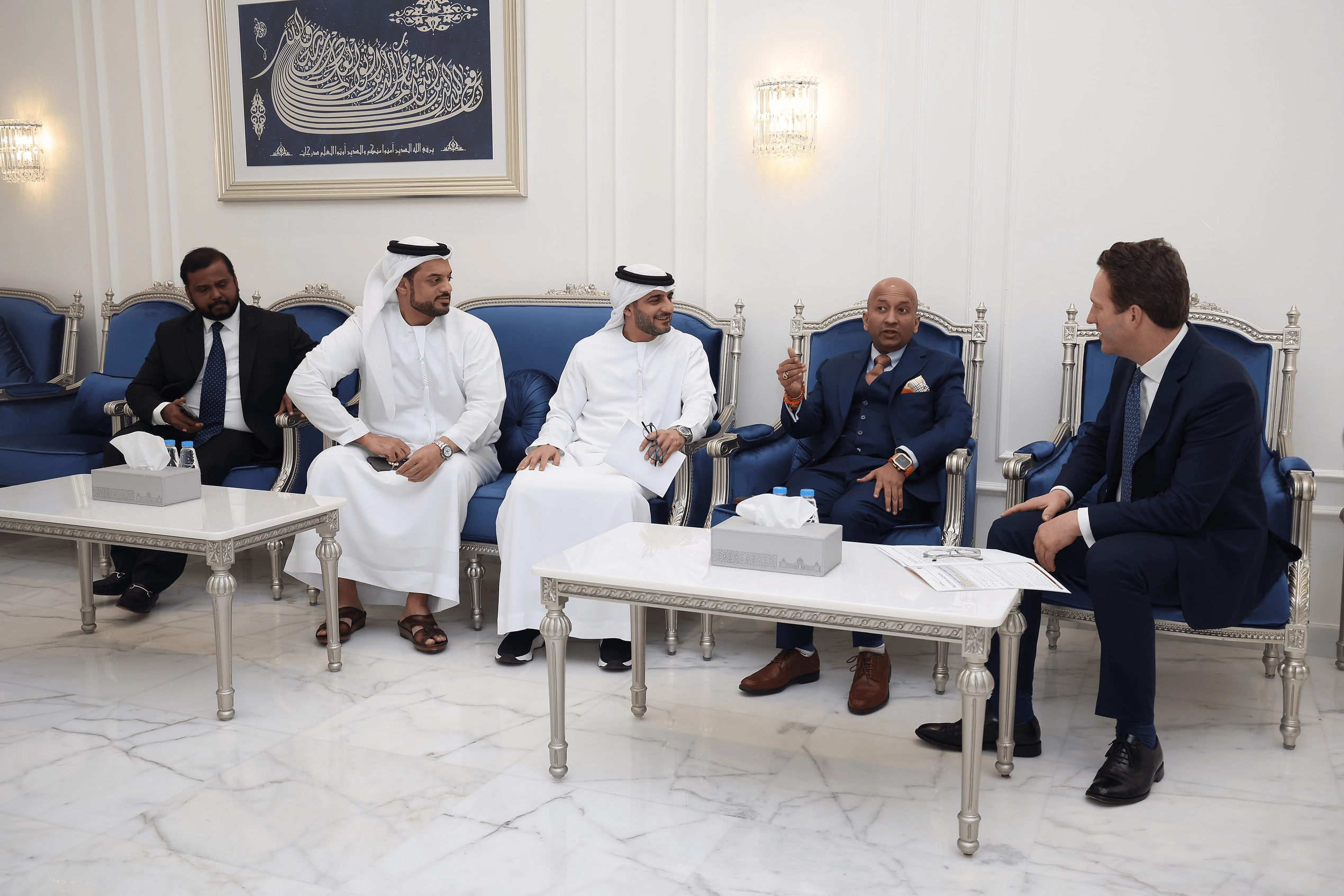

Tradition Meets Modernity: Sharjah as a Regional Leader in Economic Diversification and Sustainability

This conversation brought together regional stakeholders to highlight Sharjah’s strategic evolution into a diversified investment hub. Panelists discussed the Emirate’s growth across healthcare, technology, and sustainable finance—showcasing how it blends cultural heritage with forward-looking development. From robust infrastructure and regulatory incentives to its emphasis on innovation and green energy, the session emphasized Sharjah’s rising appeal as a dynamic and business-friendly destination for global investors.

Co-Investment Landscape: Resource Pooling and Unique Opportunities

This panel brought together leading experts who provided valuable perspectives on the power of co-investment strategies in today’s evolving financial landscape. Speakers highlighted how partnerships between investors with specialized expertise can unlock unique opportunities across private equity, structured credit, and cross-border real estate. They emphasized the importance of risk mitigation, liquidity access, and strategic diversification in achieving sustainable long-term returns.

Family Office 2030: Alternatives, Technology, and the Role of AI

This discussion featured industry leaders exploring the transformative role of AI, fintech, and digital innovation in modern family offices. Panelists examined how AI is enhancing investment decision-making, risk assessment, and operational efficiency, while also cautioning against over-reliance on automation. The session also covered emerging alternative asset classes and the growing influence of private debt, offering insights into the future of wealth management in a rapidly evolving financial ecosystem.

United in Empathy: Aligning Family Values with Strategic Philanthropy

This session gathered experts in philanthropy and social impact investing to discuss how family offices are integrating values-driven giving with financial sustainability. Panelists explored emerging trends in impact investing, education, and healthcare, emphasizing the need for structured frameworks to measure success. The conversation underscored the shift towards strategic philanthropy, where long-term vision and measurable outcomes define effective giving.

Growing Pains: Governance, Succession Planning, and Next-Gen Engagement

This panel featured distinguished speakers addressing the evolving governance challenges facing family offices and the critical role of succession planning. Experts shared insights on balancing tradition with modernization, ensuring leadership continuity, and preparing the next generation for responsible wealth stewardship. The discussion reinforced the importance of clear governance structures and proactive engagement strategies to sustain family legacies across generations.